Plastic sector in Italy and Europe

Today I wanted to delve into and share the topic of plastics, trying to stay as much as possible within the Italian, or at most European, framework.

The report published in April 2022 by ECCO the Italian climate think tank is very useful and provided most of the information shared in this article.

I have chosen to share this information as part of my site dedicated to sustainable tourism because the plastics problem is complex and needs to be addressed on several levels: personal, corporate, in the economic market (supply/demand) and of course public.

Knowing how it is produced and how it can be eliminated helps to understand which paths to take with a view to reduction. It also helps to understand why reduction is necessary and why certain changes in our habits are essential to be able to change the business models of companies we may have among our suppliers.

I am Sara, a consultant for the tourism sector, and on this site I talk about tourism, sustainability, theory and concrete practices to become a more sustainable operator or operator.

Here is the updates published on February 2024 about plastic in Italy and Europe.

THE PLASTICS SUPPLY CHAIN IN ITALY

The term plastic refers to a vast series of polymeric materials, i.e. made up of long chains of carbon and hydrogen, in which other elements may also be present, giving rise to numerous materials with different characteristics.

In fact, plastics are characterised by a wide range of properties, which have made them practically indispensable in many sectors.

In Europe, 99% of virgin plastics are produced using oil and natural gas as raw materials, i.e. fossil sources such as naphtha, a product obtained by distilling oil.

- Naphtha undergoes the process of steam cracking, which consists of heating the hydrocarbon feedstock to high temperatures. Through this (energy-intensive) process, simple molecules, called monomers, are obtained.

- Next, polymerisation takes place, which is a chemical reaction during which the monomers join together to form polymers.

- Additives and colouring agents are then added to these to give the polymers the desired characteristics (by means of a chemical process). In this way, so-called compounds are produced.

- The paste that is formed is then transformed into granules and powders, which undergo further processing, depending on the type of plastic material and object to be created.

In 2020, 1.9 million tonnes of fossil polymers were produced in Italy, mainly polyolefins, such as polyethylene (PE) and polypropylene (PP), but also polystyrene (PS) and polyamides (PA).

In Italy there are numerous compounders, i.e. those companies that buy polymers and additives and, through mixing operations, produce polymer formulations (compounds) for specific uses.

The plastics processing sector is also particularly developed in Italy: 5.8 million tonnes of polymers were processed in 2020.

PLASTICS USE SECTORS

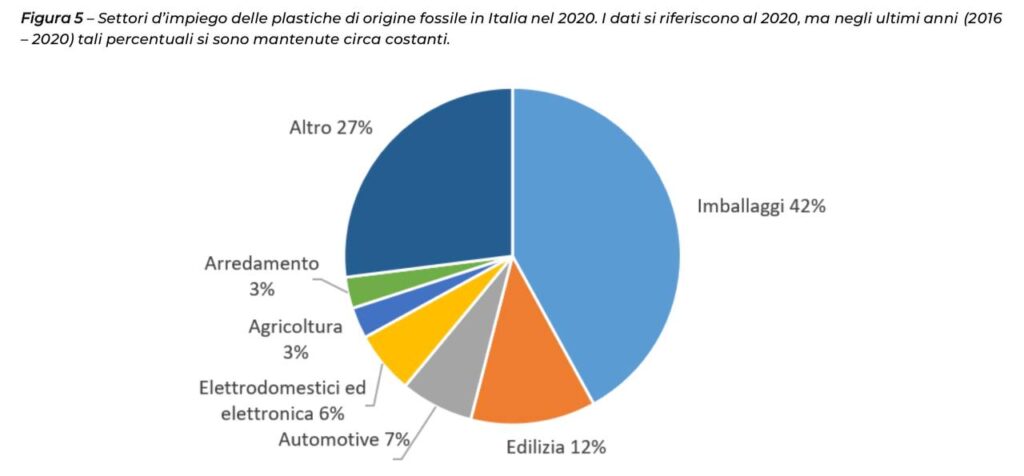

Italy is the second largest consumer of plastics in Europe: 5.9 million tonnes of fossil polymers were consumed in 2020, corresponding to 98.6kg per person.

42% of the plastic consumed in Italy is used in the packaging sector, products characterised by a short life span and whose final fate is almost always to become waste.

The most widely consumed plastics in Italy are polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), polystyrene (PS), both as is and expanded (EPS), and polyamides (PA, including PA66, the so-called nylon).

THE BIOPLASTICS SUPPLY CHAIN IN ITALY

Difference between European and Italian definitions of bioplastics

According to the European definition, bioplastics are those plastics that are derived from plant raw materials (biobased), that have the characteristics of being biodegradable and compostable, or that have both properties.

The Italian definition, adopted by assobioplastiche (trade associa)instead considers only biodegradable and compostable plastics as bioplastics, whether they are plant-based or fossil-based.

In the article, as in the report I am sharing, I will continue to refer to bioplastics according to the European definition.

100% biobased plastics can contribute significantly to the reduction of greenhouse gas emissions from the plastics supply chain, as they are produced without the use of fossil raw materials.

Currently, bioplastics account for less than 1% of the 367 million tonnes of plastics produced worldwide. However, in the face of a slight decrease in global plastic production, the market for bioplastics continues to grow.

In Italy in 2020, 111 thousand tonnes of biodegradable and compostable polymers (fossil and vegetable) were produced by 280 companies with almost 3 thousand employees.

Beyond the absolute numbers, which are still certainly low, it should be noted that the sector is growing at an extremely high rate, while there is no growth in the fossil polymer sector. The growth rate of Italian production of biodegradable and compostable bioplastics has been over 180% since 2012 and over 9% in the last year.

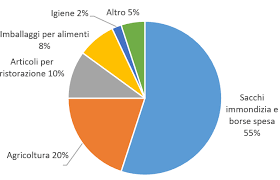

The development of this market has been fostered by a number of legislative measures, especially those related to the use of compostable bags for organic waste collection. The most important fields of application for these polymers are the production of bags for the collection of the organic waste fraction, shopping bags and in agriculture ( Figure 9).

A note of credit to Italy

Italy has a special position in Europe for the use of compostable bioplastics. The use of compostable bags, combined with the world of organic waste treatment and the law that has banned the use of traditional plastic carrier bags, is probably one of the components that has allowed Italy to be more advanced in food waste recycling than the European average (47% vs. 16% of the European average).

The Italian law on carrier bags came into force on 1 January 2011 and provides for the banning of traditional plastic carrier bags to be replaced by biodegradable plastic ones.

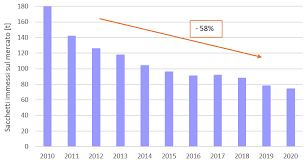

This regulation has helped both to change the polymer typically used for the production of these bags (polyethylene – PE) to biodegradable polymers, but also to decrease the overall consumption of bags.

Following the entry into force of the law, in fact, there has not been a ‘one-for-one’ substitution of traditional plastic bags with bioplastics but, as shown in Figure 10, there has been a decreasing trend in bag consumption, from almost 180 tonnes in 2010 to 74.5 tonnes in 2020. The result of the law, therefore, is certainly positive, as in 10 years the consumption of carrier bags has decreased by almost 60%.

However, an illegal trade in non-standard polyethylene bags also emerged. Although the trend is positive, given the growth of the market for standardised bags, still in 2020 almost 20 per cent of take-away bags were non-standard items.

PLASTICS AND CLIMATE CHANGE – THE POINT AT 2022

In Europe, 99% of virgin plastics are produced using oil and natural gas as raw materials and fossil fuels are also used to generate the heat needed during the production process.

This results in the emission of around 1.2 kg of CO2 into the atmosphere for every kg of plastic, considering the production phase alone. If the CO2 emissions related to the extraction and refining of fossil fuels are also taken into account, the production of 1 kg of plastic results in a total of approximately 1.7 kg of direct CO2 emissions.

After use, plastic waste is collected for disposal. In 2018, 3.6 Mt of plastic waste was collected in the country, of which 31.4% was destined for recycling, 35.8% was landfilled, and the remaining 32.8% was destined for energy recovery .

Although electricity and heat are generated in the energy recovery process, replacing, at least partially, the use of fossil fuels in the energy sector, material recycling processes should be preferred, in order to establish a true circular carbon economy, closing the carbon cycle.

In the case of mechanical recycling of plastics, direct emissions are zero, while indirect emissions are about 0.5 kg CO2/kg of plastic.

These indirect emissions can be lowered by exploiting renewable sources for electricity generation.

The emissions of bioplastics depend on the raw material used for their production.

If of fossil origin, bioplastics are associated with the same emission levels as traditional plastics.

If of plant origin, there are 0.4 t CO2/t of plastic direct emissions from the polymerisation process.

However, there is also a removal of CO2 from the atmosphere during biomass growth, which depends on the type of plants used and the bioplastic produced and can generally be assumed to be around 1.4 t CO2/t of bioplastic. This results in negative net direct emissions of approximately 1 t CO2/t of bioplastic. No data on indirect emissions of biobased plastics were found in the literature.

THE EUROPEAN REFERENCE FRAMEWORK AND NATIONAL PLANS (PNIEC, LTS, PNRR)

An examination of the European regulatory framework reveals the attention paid by the EU legislator to the issue of reducing the consumption of virgin plastics. The main initiatives carried out by the European Union are:

- PLASTICS IN THE ACTION PLANS FOR THE CIRCULAR ECONOMY;

- PLASTICS IN THE EUROPEAN TAXONOMY OF SUSTAINABLE FINANCE;

- THE EUROPEAN PLASTIC TAX;

- THE EUROPEAN DIRECTIVE ON SINGLE-USE PLASTICS.

Let us look at some more specific information.

- The use of increasing quantities, the low recycling rate, especially when compared to other materials, the high dispersion and persistence in aquatic and terrestrial environments, as well as the increasing contribution to climate change, have prompted the European Union to include plastics among the materials to be prioritised for action in the Action Plan for the Circular Economy.

The Plastics Strategy for the Circular Economy (the so-called Plastics Strategy) was adopted in January 2018 and stipulates that by 2030 all plastic packaging placed on the European market must be reusable or recyclable.

In June 2020, the European Parliament adopted the Sustainable Finance Taxonomy Regulation, an act that will help guide investment choices in line with EU environmental policy objectives.

The regulation states that plastic production contributes to climate change mitigation if at least one of the following criteria is met.

- it is produced entirely by mechanical recycling;

- it is produced entirely by chemical recycling and if the life cycle greenhouse gas emissions are lower than if fossil raw materials were used;

- it is produced from renewable raw materials and if the life cycle greenhouse gas emissions are lower than they would be if fossil raw materials were used.

- The European plastic tax is a uniform rate on non-recycled plastic packaging waste produced in each Member State, in force since 1 January 2021 and equal to 0.8 €/kg42 . The cost for Italy, net of the flat rate reduction, is expected to be around €900 million per year.

These contributions are allocated to the European budget, which is in turn used to finance the National Recovery and Resilience Plan (NRP).

- The need for a drastic reduction of plastic waste and to counter the phenomenon of its dispersion in the environment has resulted in the approval of Directive 2019/90445 , also known as ‘SUP’ (Single Use Plastics).

The directive aims to reduce the consumption of natural resources by promoting reusable alternatives at the expense of single-use and by encouraging recyclability and the increasing use of recycled material for the manufacture of new objects.

The European Commission has introduced new rules on the disposable plastic products most commonly found as litter on European beaches and seas, and on fishing equipment accidentally lost or abandoned.

Despite the great attention at European level on the issue of plastics, neither the National Integrated Energy and Climate Plan (NIPEC49) nor the Long Term National Strategy (LTS50) offer scenarios for industrial decarbonisation such that it is not understandable what policies and measures the legislator intends to adopt for such an important sector of our economy.

As a consequence, there is neither a plan nor guidelines for reducing greenhouse gas emissions from the plastics supply chain.

In the National Recovery and Resilience Plan (NRP), the petrochemical sector is only indirectly involved in section M2C1 ‘Circular Economy and Sustainable Agriculture’, where EUR 0.6 billion is allocated to ‘Circular Economy Flagship Projects’. This investment aims to support the improvement of collection and development of plants for the recycling of various materials, including plastics, by encouraging projects that have the characteristics of ‘circular districts’. However, investments are not framed within a clear industrial strategy to decarbonise plastics and, at the moment, the initiative is fragmented.

Three ‘pillar objectives’ can be identified around which policies can be built to contribute to climate neutrality goals and, at the same time, to tackle plastic pollution:

- Reducing plastic consumption, particularly in the packaging, construction and automotive sectors, which are the main consumers of plastics in our country;

- Increased recycling and reuse rates, which reduce emissions and imports of CO2-intensive materials;

- Use of bioplastics. Plastics made from plant raw materials are potentially a solution to solve environmental problems in those applications where existing alternatives do not allow it.

STRATEGIES FOR REDUCING CONSUMPTION

Since its introduction onto the market, the production of plastics has shown continuously growing increases that, at least in recent decades, have not been significantly reversed (Figure 17). In just a few decades, world production has risen from 15 million tonnes in 1964 to 368 million tonnes in 2019.

The efforts made so far appear insufficient to bring this production system back to real sustainability. Commitments made so far by companies and governments around the world are not ambitious enough to actually stem the resulting problems. The sectors that most require the use of plastics are: food and beverages, construction and automotive. The examples given refer specifically to the food and beverage sector.

DISPOSABLE DISPOSAL

In the food and beverage industry, which has made single-use its business model, there is an urgent need to prioritise the demand for raw materials for the production of packaging and single-use items by taking measures to

- Eliminating unnecessary packaging and reducing single-use;

- Increased use of reusable products;

- The replacement of plastics with other materials.

Dematerialisation of packaging means the elimination of unnecessary and problematic packaging through redesign, innovation and the introduction of new models for selling and distributing products. This can start with the direct elimination of superfluous and oversized packaging (overpackaging).

Even the purchase of bulk products, where the consumer ‘refills’ the container several times, makes it possible to significantly reduce the use of bottles, flasks and containers mainly in the detergent, personal hygiene and cosmetics sectors, where sterility and contamination requirements are much less stringent than in other areas (e.g. in the food and pharmaceutical sectors).

REUSE

Reusable containers and tableware are made of materials that can be washed, sanitised and reused, such as glass, ceramics and steel, and reduce the consumption of disposable products. The environmental benefits of systems based on reusable packaging were confirmed by the recent UNEP report ‘Addressing Single-Use Plastic Products Pollution using a Life Cycle Approach’, UNEP, 2021.

In France, reuse targets are introduced for all types of marketed packaging of 5% by 2023 and 10% by 2027.

Parallel to the transposition of the UDS, Germany introduced further measures in a new packaging law. From 2023 restaurants, bistros and cafés will be obliged to make food and beverages available to consumers also in reusable containers, both for consumption on the spot and for take-away.

SUBSTITUTIONS WITH OTHER MATERIALS

With bio-based materials it is possible to create lighter and stronger packaging, or simply more sustainable materials, by replacing fossil-based raw materials with a natural, biodegradable raw material. One example is microfibrillated cellulose (MFC), a material derived from wood that can replace fossil plastic in applications such as packaging, barrier films, special papers, coatings and adhesives.

SCENARIOS

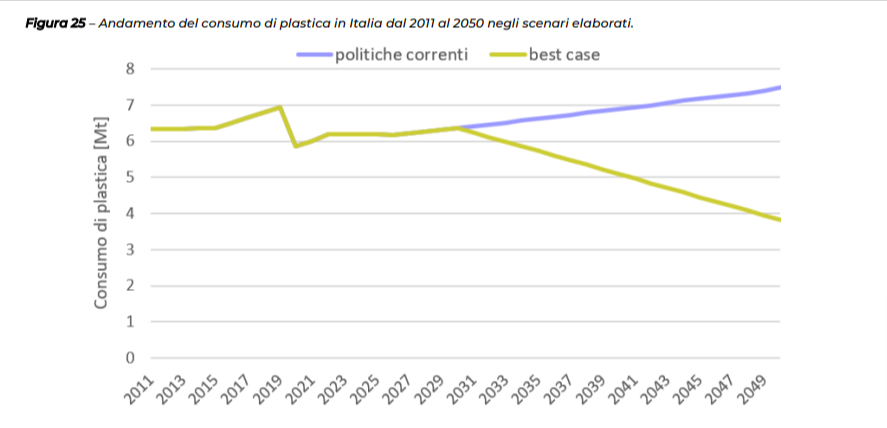

Two scenarios to 2050 (current policies and best case) have been developed concerning plastic consumption in Italy and the CO2 eq emissions associated with this consumption.

In the 2050 Current Policies Scenario it is assumed that plastic consumption increases by 5% every six years, as observed in the years 2011-2017.

In the Scenario 2050 best-case, it is instead assumed that by eliminating overpackaging and reducing the consumption of single-use plastic packaging and plastic consumption in other sectors as well, the consumption growth trend will be reversed, reaching 3.8 Mt in 2050.

The emissions associated with this plastic consumption were then calculated. The plastic consumed and not the plastic produced is taken into account since our country is a large consumer of plastics, but polymer production is low.

In the Current Policies 2050 Scenario, it is assumed that still more than half of the plastic placed on the Italian market is fossil and the remaining plastic is from recycled or biobased material. Considering end-of-life, it is assumed that 70% of post-consumer plastic waste is recycled; the rest is destined for waste-to-energy or industrial composting. This scenario results in a 9% reduction in emissions compared to 2020.

In the Scenario 2050 best case it is assumed that no more plastics of fossil origin are placed on the Italian market, but only produced from recycled material and biobased plastics.

Accepting European calls for the elimination of landfilling and the reduction of CO2 emissions through incineration, it is assumed that more than 90% of plastic waste will be recycled, thanks to major improvements in plastic collection, sorting and recycling. In this scenario, an emission reduction of 98% compared to 2020 is achieved.

The 2050 Best Case Scenario is a very ambitious scenario. In order to achieve these results, various policy instruments need to be put in place that will first of all reverse the growth trend in consumption and, at the same time, allow recycled and biobased plastics to occupy larger and larger market segments.

POLICIES AND MEASURES TO DECARBONISE THE PLASTICS SUPPLY CHAIN

The deposit system is, for example, an effective tool to increase packaging reuse and recycling rates. In countries where this recycling system is compulsory by law, beverage container collection rates of up to 94% are achieved. A deposit system would allow our country to significantly reduce environmental pollution and to pursue the ambitious European targets for collection and recycling and the decarbonisation of the sector.

A specific regulation introducing deposit systems for plastic beverage containers was included in the 2021 Semplificazioni bis decree. However, we are still waiting for an implementing decree to be issued in Italy to actually bring the deposit system into force.

The introduction of regulatory tools to encourage the transition from disposable to reusable products also plays a decisive role among the policies adopted or being adopted in several European countries.

Such instruments could also be included in the mix of national measures, avoiding that instruments to fight plastic single-use leave the disposable model intact.

Taking the French legislation as an example, a reuse target for all types of marketed packaging of 5% by 2023 and 10% by 2027 could also be introduced in Italy.

A command-and-control measure could also be introduced in Italy by setting binding targets for the progressive reduction of single-use packaging.

In this regard, two measures have been identified that could be adopted in our country in the short term:

- Banning the sale of fresh fruit and vegetables in plastic packaging. This ban could initially be introduced only for certain types of less perishable products, and then be progressively extended to all fruit and vegetables, leading to a total ban on such packaging by 2026;

- To prohibit commercial establishments from providing disposable tableware of any material for consumption on the spot, with the obligation to use reusable alternatives.

In order to improve the quality of recyclate and thus reduce the need for virgin plastic, it is possible to intervene upstream, with product eco-design aimed at simplifying polymer compositions and disassembling products into homogeneous components from the point of view of the constituent polymer.

These strategies make it possible to improve the mechanical recycling of many plastic products, making it possible both to increase recycling rates and to produce higher quality secondary products.

In order to keep the Italian industry competitive, to protect employment and to steer companies towards economic activities that are compatible with long-term climate neutrality objectives, it is also necessary to act on the demand side, favouring the creation of a market and a demand for secondary raw materials and bio-based plastics, for example, with specific requirements to be adopted in public procurement.

Sources

The main source of all this information is the report published in April 2022 by ECCO the Italian climate think tank. https://eccoclimate.org/wp-content/uploads/2022/04/La-plastica-in-Italia_Rapporto.pdf

Sara – tourism sector consultant

PS. Do you want to GROW your business with POSITIVE impact… without huge investments? Sign up for the email list by clicking on START HERE!

Or click this link https://www.sustainabletourismworld.com/start-here/ to download my INFOGRAPHIC!